| ||

Friday, July 29, 2016

Importing from China to Singapore: A Complete Guide

Monday, July 18, 2016

Buying in China and Selling on Amazon – Part 3: Product Guidelines

Importing Insider Newsletter

Stay ahead of your competitors. Get access to our latest content.

Contact us now: +60126694217

Get your own Copy...

Become a better person than you are now....

Email us: alveolegame@gmail.com

The best Guides that you'll ever have...

In part, these terms refer to US product regulations and compliance, but also other, non-regulatory requirements sellers must meet in order to participate.

In this article we explain Amazon’s terms for CPSC product compliance, defective products and counterfeit items.

As always, we also explain how each term relates to the risks involved when importing from China, and other Asian countries.

If you’re interested in reading the first two parts of the series, you find them here:

CPSC Compliance Requirements

“Sellers are responsible for tracking and complying with any regulations issued by the CPSC.”

Compliance with applicable US product regulations is never optional, regardless of whether or not the items are sold on Amazon.com.

However, Amazon’s Seller Policy is explicitly referring to these regulations, clarifying that compliance is the sole responsibility of the seller.

Ensuring product compliance when buying from China is, in my opinion, the biggest challenge faced by American importers. Below I explain the three main reasons:

- Only a fraction of the suppliers in China can show previous compliance with US regulations (e.g. CPSIA & California Proposition 65)

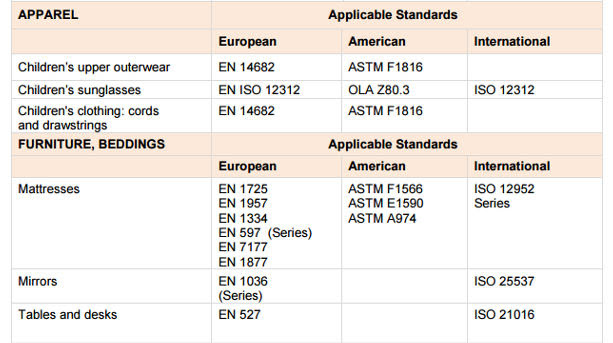

- It’s often complicated to determine which regulations (often more than one) apply to a certain product.

- Ensuring compliance often requires product testing, which is costly.

Ensuring compliance is critical, not only for Amazon sellers, but all importers.

At best, non-compliance results in a forced recall. However, you may also be forced to pay millions of dollars in damages, in case someone is hurt, or if property is damaged.

Before you get started with your imports, you must first confirm which regulations apply to your product, and then limit your supplier selection to those who can prove that have a verified compliance record (e.g. previous test reports, certificates and American buyer references).

In addition, Amazon also requires the seller to comply with all applicable labelling requirements. These labeling requirements are often part product regulations, such as the CPSIA.

Amazon.com provides templates, that enables sellers to add warning labels (e.g. Choking Hazard Warnings) directly to the product page.

Follow the links below to learn more about US product regulations and labelling requirements:

- Consumer Product Safety Improvement Act (CPSIA)

- Consumer Product Safety Commission (CPSC) Regulations

- California Proposition 65

- Product Testing and Certification

- Product Labelling Regulations

Unacceptable and Prohibited Items

“Items in any of the following conditions are unacceptable for listing on Amazon.com:”

- Item does not work perfectly in every regard.

- Item is not clean, including signs of mold, heavy staining, or corrosion.

- Item is damaged in a way that renders it difficult to use.

- Item is missing essential accompanying material or parts. (This does not necessarily include instructions.)

- Item requires repair or service.

- Item was not created by the original manufacturer or copyright holder. This includes copies, counterfeits, replicas, and imitations.

- Item was originally distributed as a promotional copy, promotional bundle, product sample, or advance reading copy. This includes uncorrected proofs of in-print or not-yet-published books.

- Any aspect of the item is obscured and not able to be read or viewed because of markings, stickers, or other damage.

Item is prohibited for sale on Amazon.com.

As any reputable marketplace, Amazon.com has set certain product requirements the sellers must fulfill.

At a glance, these requirements may seem rather simple and easy to comply with, but things always tend to get a lot more complicated when importing from China.

Keep reading, and I’ll explain what you must know about defective items, damages and counterfeits.

Defective items

It’s impossible to completely avoid quality issues when importing products from China. That said, the severity and rate of these defects can be effectively reduced, and controlled, by implementing a comprehensive Quality Assurance (QA) strategy.

It may sound like a monumental task, too big for any small business to implement. In fact, QA is not as complicated as it may seem.

What truly matters is that you implement a QA strategy from the very beginning, and not only in the later stages of the process. Click here to read more about avoiding defect and damaged products when selling on Amazon.com.

Damages, dirt, corrosion and mold

Apart from Quality Issues, transportation damages is another major risk. Many Chinese suppliers lack internal export packaging guidelines. As a result, many suppliers use cheap and substandard export packaging, thereby vastly increasing the risks of transportation damages.

During transportation, your cargo must be able to withstand heavy pressure from other cargo (especially when shipping LCL), shocks, humidity and liquids.

Always provide your supplier with clear export packaging quality requirements, and instruct your quality inspector to include the packaging in the inspection protocol. Below follows some general export packing quality recommendations:

- Pallets: Wooden ISPM 15 Pallets (1200×900 mm)

- Outer cartons: 5 layer cardboard

- Inner cartons: 3 layer cardboards

- Plastic wrapping: Yes (Outer cartons)

- Plastic straps: Yes (Shall fix Outer cartons to wooden pallets)

Amazon Anti-Counterfeiting Policy

“The sale of counterfeit products, including any products that have been illegally replicated, reproduced, or manufactured, is strictly prohibited.”

This area is tricky. I think most of you understand that importing fake Gucci bags is not a good idea. However, things are not always as clear cut as obvious fakes VS original designs.

How do you know if that stainless steel coffee pot is an original design, or a replicate of some obscure Danish design company you’ve never heard of?

There’s a reason Chinese manufacturers aren’t famous for being the worlds leading innovators.

The items you see on sites like Alibaba.com are generally referenced products – either based on the products ordered by previous customers, or products that are more or less “inspired” by other brands.

That said, some Chinese manufacturers also develop their own designs, but I dare to say they are a minority.

In fact, we’ve had a few cases when our clients’ products turn up on a suppliers Alibaba.com page. Luckily, Alibaba.com has become much better at acting against IP infringements.

But, Alibaba.com, and other B2B supplier directories, can only act if they the infringement is reported.

While there may not be any cost efficient way to be 100% sure your product is not infringing on another company’s IP, there are still a few precautions you can take in order to reduce your risk of importing counterfeit items:

1. Create your own custom designed product

2. Modify an existing product

2. Modify an existing product

Returns, Refunds, & Cancellations

“Here are some situations when you may need to refund, accept returns or cancel orders:”

- You can’t fulfill an order.

- The customer doesn’t receive your order.

- The customer returns an item.

- The customer files a credit card chargeback or an A-to-z Guarantee claim.

- The customer requests you cancel an order.

- The buyer is unable to receive the order at the address provided.

There are various reasons you are forced to refund a customer. Below I explain what you must know about the two most common reasons.

Returns

A customer is not always returning products due to defects or damages, even though quality issues are very likely to result in a high return rate. However, managing quality issues is already covered in this article, so let’s look into how you could end up in a situation where you fail to deliver orders.

You can’t fulfill an order

In order to avoid a situation where you fail to deliver the products, you need to maintain a sufficient quantity in stock. This is often easier said than done.

For natural reasons, importers want to avoid excessive inventory. On the other hand, lead times to restock are long, and prone to delay.

Chinese suppliers rarely keep products “off shelf”, and certainly not products compliant with US product regulations (e.g. California Proposition 65).

Your items must be manufactured before they are shipped, a process which usually takes 30 to 50 days, largely depending on the quantity and complexity of the product.

Then the cargo must be shipped from China to the United States, adding on another 20 to 35 days. In total, you are looking at 2 to 3 months, before the items are restocked, counting from the order date.

However, that is assuming you face no delays whatsoever. But delays are common in China. Maintaining sufficient inventory is complicated, and requires very serious planning.

It’s also a critical Sales Performance signal, that has a great effect on your ratings on Amazon.com. Click here to read more about how you can avoid delays when importing from China and selling on Amazon.

Product Packaging

Amazon’s terms are not limited to the products, but also specify strict requirements forproduct packaging. In most product categories, the packaging requirements are related to whether the item is marketed as new, used or refurbished.

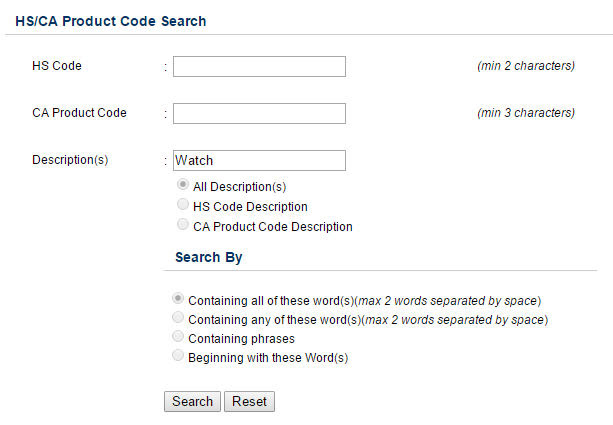

However, certain products must be delivered in a new, and unopened, packaging. This is what Amazon.com requires for wristwatches:

“All watches must come in their original packaging, including all original packaging materials and instruction manuals.”

Also, even if not explicitly referred to in the Amazon.com Participation Policy, all US packaging regulations, and labelling requirements, are applicable.

Before you place an order, you need to confirm which apply to your products, and verify the supplier’s previous compliance record.

Thursday, July 14, 2016

Slowing China Economy Ripples Into Laos

A slowing in China’s economy is having rippling effects on Laos, which has been described by the World Bank as having “once of the fastest growing” economies in the East Asia and Pacific region.

A decade long mining boom, combined with a rapid development of hydropower, has seen Laos’ growth rate reach over 7 percent a year, allowing national output to more than double, generating some half a million jobs.

A key player in the economic progress has been China. A recent World Bank report on the Lao economy noted China’s influence was continuing to grow.

China is the leading investor, with $6.7 billion in 760 projects from mining, to energy, agriculture, banking and trade as well as construction of commercial properties.

In 2015, China accounted for more than 40 percent of Laos’ public external debt, up from 35 percent three years earlier, with the funding focused on infrastructure and power projects.

Slowdown

But signs of a spillover from a slowing in China’s economy has come in a downturn in bilateral trade, according to senior Lao officials. Two-way trade accelerated from just $1.3 billion in 2011 to reach $3.6 billion in 2014. But it slid to $2.78 billion last year.

Laohoua Cheuching, a senior official in the Ministry of Industry and Commerce, recently told Lao media that new initiatives are needed to stem the slowdown.

Laohoua said the downturn was due in part to a slowing global economy. Lao exports to China focus on mining and agriculture, especially rubber, while key imports are machinery and electronic equipment.

“We have to find new products to export to offset the loss. If not the value of our exports to China will decline further,” Laohoua told the Vientiane Times.

The World Bank has also raised concerns over the slowing China economy that “may effect some potential investment on pipeline projects that do not have secured financing.”

China is also a key investor in real estate. In Vientiane, Chinese owned commercial buildings stand developed or under construction. This includes the $1.6 billion That Luang Lake residential and commercial complex covering 365 hectares.

In December last year, Chinese and Lao officials witnessed the “ground breaking” ceremony for a 427 kilometer $6.04 billion high speed rail line from Vientiane to the Chinese border. The project, requiring 100,000 Chinese workers, was the mainstay of former deputy prime minister, Somsavat Lengsavad.

But Vientiane-based analysts told VOA the project’s cost and the departure of Somsavat from the government has created some uncertainties about the project.

Diversification

Analysts say Laos’ dependence on China and narrow industrial revenue base of hydropower and mining leaves the Lao economy vulnerable.

Asian Development Bank (ADB) senior country specialist, Shunsuke Bando, said Laos has to diversify especially amid rising competition from the ASEAN Economic Community (AEC).

“The economic structure is heavily reliant, heavily dependent on mining, electricity. So in this context the country has to diversify its economic structure,” he said.

“They have to expand their industrial bases, such as textile garments, food processing and so on – is more important for this country’s future,” Bando told VOA.

The ADB says growing regional competition, a weak industrial base and human resource skill shortages are undermining the Lao business sector.

“They are lacking and running short of skilled workers. Even the low level workers, their skills are very low compared to other countries,” Bando said.

Faced with economic uncertainties, Lao Prime Minister Thongloun Sisolith has moved to strengthen regional business and economic ties, signing key trade agreements with Cambodia and Thailand during recent official visits.

Pavida Pananond, a professor of international business at Thammasat University in Bangkok, said Thongloun’s strategy appears to be directed to building on Laos’ regional connectivity.

“It’s not surprising that the Lao Prime Minister would now be trying to change the perspective that this is a land locked country but a land linked [one] because he wants to make use of regional integration,” Pavida told VOA.

Signs of success in diversification are starting to emerge. Laos has in place more than 10 special economic zones throughout the country, with 200 registered businesses in different stages of development.

The economic zones largely focus on entertainment services, logistics as well as manufacturing and commerce, employing more than 11,000 workers, 60 per cent of whom are foreign.

ADB analysis says Laos is expected to be “well positioned to tap on new market opportunities arising from deeper ASEAN integration”.

“Deeper integration could accelerate growth and development and contribute to achieving Lao PDR’s goal of graduating from least-developed status by 2020,” the ADB said.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Great offer for you......... If you are entrepreneurs or want to be one.... or you are knowledge thirsty person....

This book is a must have on your list..........

Just for USD$15 you can have the overall knowledge about venturing into China and its supplying markets.

So many people are benefiting from this book.. Why not you? They are making Millions of Dollars every single day of you siting and thinking about doing somethings... Invest in just a small amount to get so many insight about China markets..

Yiwu is the biggest Wholesales Market in the world. If you want to venture into China, Yiwu is the first place you want to visit. So many things that you can see, learn, find there... Trust me, you'll never get lost if you have this book with you......

Don't wait until tomorrow........ Act now..

Contact us: +60126694217 (Call/Whatsapp)

Email us: alveolegame@gmail.com

Get your copy now... Available on Both E-Book and Hard Cover Format...

Shipment all around the world via DHL/FEDEX/UMS

Friday, July 1, 2016

Import from China to the UK: A Complete Guide

| |||||||||||||||||

|

Subscribe to:

Posts (Atom)