Source: ChinaImportal

Most manufacturers in China, and other developing Asian countries, are unable to ensure compliance with overseas product safety standards and substance regulations. As such, a supplier’s ‘compliance track record’ (i.e., previously issued certificate and test reports, held by the supplier) is a key signal when selecting a manufacturing partner.

However, in many industries, very few suppliers can provide said documentation, therefore leaving foreign buyers with little information to judge a supplier’s technical capability and expertise. In other industries, the number of suppliers with extensive compliance track records is larger – but still requiring buyers to apply comprehensive testing strategies. In this article, we explain how you can assess manufacturer capabilities and manage compliance strategies in four different industries; Apparel & Textiles, Watches & Jewelry, Electronics and Toys & Children’s Products.

Apparel & Textiles

Importers generally only deal with the apparel manufacturer, on the surface of the supply chain. The apparel manufacturer in turn purchases fabrics and components (i.e., buttons and zippers) from subcontractors. Nothing unusual here. However, most apparel manufacturers are unable to produce any compliance documents whatsoever. Our conclusion is that most test reports are held by buyers, and fabrics suppliers. That said, don’t expect the apparel manufacturer to share information about either their subcontractors, or customers. As a result, the buyer is, as usual, left guessing. The truth is, that many (especially small) apparel manufacturers don’t know if their fabrics suppliers are able to provide compliant produce.There are of course exceptions, but most apparel manufacturers are unwilling, or unable, to present more than a few test reports. Even in a ‘best case’ scenario, buyers shall not expect that the supplier is able to provide test reports matching the specific standard to which they must ensure compliance.

To us, any substance test report is of value. An apparel manufacturer’s ability to ensure compliance is entirely dependent on the material subcontractors they normally work with. A supplier that is able to ensure compliance with REACH (EU), is therefore quite likely to be able to ensure compliance with California Prop 65 (US). Hence, buyers must be flexible when making a selection. Still, Apparel and textile buyers must be ready to implement a ‘hands on’ compliance strategy, and never assume that manufacturers can provide test reports for their specific SKUs. Because that simply doesn’t exist.

What Apparel & Textiles Buyers Must Know

- Relevant documents: Substance test reports, textiles performance test reports

- What you can tell: The supplier is likely focused on western markets, and purchase fabrics and components from ‘compliant subcontractors’

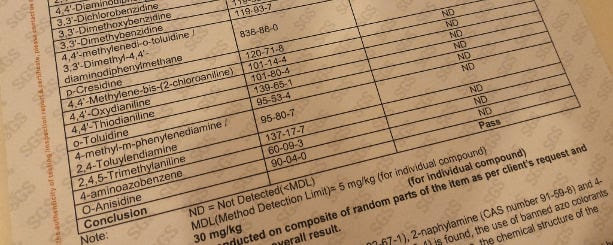

- Relevant testing standards / directives: REACH, California Proposition 65, OEKO Standard 100, AZO, Formaldehyde, Phthalates (Coated fabrics), Heavy Metals

- Compliance Strategy A: Submit material samples for compliance testing (before and/or after production)

- Compliance Strategy B: Select and verify a fabric supplier that provides materials to the apparel maker

- Risk Level: Low / Medium (Fabrics made for the domestic market may not by default be non-compliant. Heavy Metals, Formaldehyde and other restricted substances are increasingly rare. Hence, a fabric must not be custom made to pass testing).

Watches, Jewelry & Accessories

Watch and Jewelry Manufacturers can, at best, produce a few substance test reports. Most cannot. The dynamics are largely identical to the Apparel and textile industries, and the same substance restrictions apply. Therefore, there is nothing else to add, but the summary below:What Watch, Jewelry & Accessories Buyers Must Know

- Relevant documents: Substance test reports

- What you can tell: The supplier is likely focused on western markets, and purchase materials and components from ‘compliant subcontractors’

- Relevant testing standards / directives: REACH, California Proposition 65, Heavy Metals, RoHS (Quartz Movements)

- Compliance Strategy: Submit material samples for compliance testing (before and/or after production)

- Risk Level: Medium (Metallic components in Watches and Jewelry may contain excessive levels of nickel and other restricted substances. Compliance is therefore not to be taken for granted, and certainly not when buying from suppliers focused on the domestic market).

Electronics

The situation in the Electronics industry is, on the other hand, very different. Buyers of electronics products are required to ensure compliance with a variety of safety standards and directives. The supply chain as a whole is also far more sophisticated. All large component suppliers make, albeit not exclusively, RoHS compliant parts – and the assembly manufacturers can normally present a rather extensive list of compliance documents. Hence, buyers in the industry have much more to act on, when selecting a supplier.Still, buyers shall not expect manufacturers to offer catalogs filled with ‘compliant SKUs’, ready to hit the assembly lines. As always, a compliance track record indicates capability and expertise. This is further explained below:

a. A product certificate / test report is only valid for one or more (listed) SKU/s, not all ODM products in a supplier catalog. Most suppliers can only provide documentation for 5 to 20% of their product catalog.

b. Electronics are normally within the scope of two or more standard / directives. It’s very common that a supplier can present compliance documents for one such standard, while being unable to do so for others. For example, it’s very common to find products, compliant with the EU EMC (Electromagnetic Compatibility) Directive, while lacking compliance documents for RoHS and LVD (Low Voltage Directive).

c. If any components or subsystems are changed, previously issued documents are invalid.

Even when dealing with ‘high end’ manufacturers, buyers therefore find themselves in one of the following situations:

- The SKU is not compliant with any applicable product standards / directives

- The SKU is partly, but not fully, compliant with all applicable product standards / directives

- The SKU is fully compliant. However, design and component changes make previously issued compliance documents irrelevant.

What Electronics Buyers Must Know

- Relevant documents: Product certificates, test reports and technical documentation

- What you can tell: The supplier is likely focused on western markets, and purchase electrical components (i.e., ICs and subsystems) from ‘compliant subcontractors’. They also have ‘in house expertise’ to assemble products in compliance with overseas standards and regulations.

- Relevant testing standards / directives: Low Voltage Directive, EMC Directive, R&TTE Directive, RoHS, FCC Part 15, UL Standards

- Compliance Strategy A: Limit product selection to SKUs with a complete set of compliance documents

- Compliance Strategy B: Submit final pre-production prototypes to a third party for compliance testing and certification.

- Risk Level: Very High (An electronics product that is not designed and assembled specifically in compliance with applicable directives and standards is very unlikely to pass compliance testing. EU buyers must also ensure that their product is made using RoHS compliant components).

Toys & Children’s Products

Toys & Children’s Products are, for obvious reasons, strictly regulated in most major markets. American buyers, in all states, must ensure compliance with CPSIA, while EU buyers must ensure that their imported items are EN 71 compliant. These are framework regulations, which scope includes the following:- Substances (i.e., restrictions on heavy metals and phthalates)

- Mechanical Properties (i.e., buttons, drawstrings and seams)

- Certification Procedures (i.e., CPSIA Children’s Product Certificate)

- Batch Testing Requirements and Exceptions

- Labelling Requirements

What Toys & Children’s Product Buyers Must Know

- Relevant documents: Substance test reports, Physical property test reports

What you can tell: The supplier is likely focused on Western markets, and purchase components from ‘compliant subcontractors’. They also have ‘in house expertise’ to ensure compliance with regulations and standards concerning physical properties of Toys and Children’s Products.

Relevant testing standards / directives : ASTM F963, EN 71, REACH, California Proposition 65, Phthalates, Formaldehyde, Heavy Metals

Compliance Strategy: Submit final pre-production prototypes to a third party for compliance testing and certification. - Risk Level: High (A product that is not made specifically in accordance to the requirements set by, for example, CPSIA or EN 71 cannot pass testing.)

Conclusion

Regardless of industry, American and European buyers are forced to work ‘hands on’ with compliance and certification procedures. Relying on the supplier to do the work for you is not realistic. There are no shortcuts, and it will take many years, if not decades, before Chinese, and other Asian, manufacturers are able to implement procedures ensuring a more seamless experience for overseas buyers.

No.636 Jln BPJ 3A/18

Bandar Puteri Jaya

08000 Sg Petani Kedah

Tel: +60126694217

Email: alveolegame@gmail.com

Prop 65 compliance

ReplyDeleteProp 65 compliance solution services by Accord-compliance, we offer the Prop 65 compliance solution services for your supply chain.

to get more - https://accord-compliance.com/prop-65-module/